(Expressed in Canadian Dollars)

Independent auditor’s report

To the Shareholders of Antioquia Gold Inc.

Opinion

We have audited the consolidated financial statements of Antioquia Gold Inc. (“the Company”), which comprise the consolidated statements of financial position as at December 31, 2023 and 2022, and the consolidated statements of loss and comprehensive loss, consolidated statements of changes in shareholder’s equity (deficiency) and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including material accounting policy information.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2023 and 2022, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (IFRS Accounting Standards).

Basis for Opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Material Uncertainty Related to Going Concern

We draw attention to Note 1 in the consolidated financial statements, which indicates that additional funding will be necessary to maintain the Company’s ongoing operations. This condition, along with the matters set forth in Note 1, indicate the existence of a material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

Key Audit Matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

In addition to the matter described in the Material Uncertainty Related to Going Concern section, we have determined the matters described below to be the key audit matters to be communicated in our auditor’s report.

Tax exposure due to multinational intercompany balances and transactions and uncertain tax provision

Refer to Notes 3 and 17 of the consolidated financial statements.

The Company has tax exposure due to multinational intercompany balances and transactions, arising from possible exposure to tax liabilities in accordance with certain tax rules regarding foreign operations. These rules are complex and require significant management judgement including the appropriate withholding tax rate, fines and penalties likely to be applied, withholding tax refunds likely to be received, and the applicability of tax rules to certain transactions. The Company has recognized a tax liability of $2,900,000 during the year in relation to these tax positions, of which $2,200,000 relates to prior periods.

The Company’s tax exposure due to multinational intercompany balances and transactions was determined to be a key audit matter because of the significance of management’s judgments required in determining the appropriate tax provision as well as the significant audit effort required to obtain sufficient appropriate audit evidence regarding the amounts recorded.

Our audit procedures included, amongst other procedures:

- Involvement of an income tax expert to assist with:

- Evaluation of the potential for tax authorities to challenge management’s treatment; and

- Evaluation of management’s assumptions regarding effective withholding rates, refund rates, and penalties.

Impairment of long-lived assets

Refer to notes 2.6, 2.7, and 9 to the consolidated financial statements.

Costs incurred by the Company for development of the mine are capitalized and deferred as mining interests and property, plant, and equipment. In accordance with IAS 36, management identified indicators of impairment and recorded an impairment charge of $22,372,122.

Auditing management’s impairment test is complex and judgmental due to the estimation required in determining the recoverable amount of the assets The recoverable amount was estimated using a discounted cash flow model. Judgements with the highest degree of subjectivity and impact include forecasts of future operating performance, inflation rates, and discount rates. Changes in these assumptions could have a significant impact on the recoverable amount of the assets.

The impairment of long lived assets was determined to be a key audit matter given the significant auditor effort , significance of the balance to the consolidated financial statements, and that the accounting is highly judgmental and includes management judgement and estimation uncertainty with respect to the recoverable amount.

Our audit procedures included, amongst other procedures:

- Evaluated the design effectiveness of internal controls over the estimation process used by management

- Evaluated the reasonableness of management’s forecasts of future operating performance by comparing the forecasts to:

- Historical operating performance

- Publicly available data including previous reserve reports published by the Company

- With the assistance of valuation specialists, evaluated the reasonableness of discount rates by:

- Tested the source information underlying the determination of discount rates and future gold prices

- Reviewed relevant internal and external information, including publicly available market data to assess the reasonability of the discount rate

- Developed an independent point estimate for the impairment charge and compared it to the impairment charge developed by management.

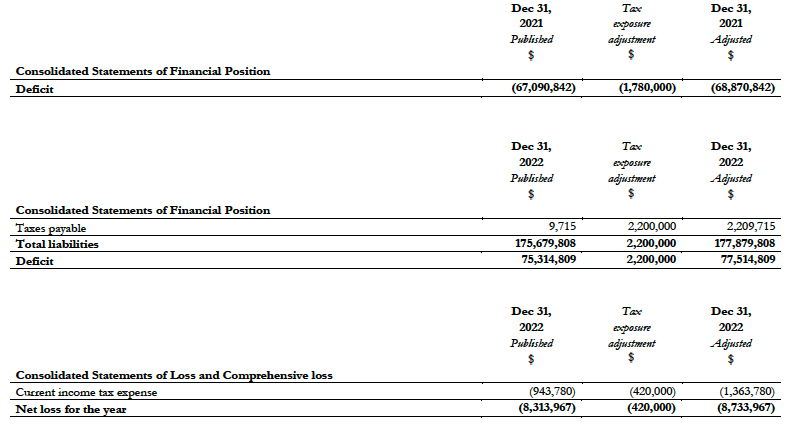

Emphasis of Matter – Restated Comparative Information

We draw attention to Note 3 in the consolidated financial statements, which explains that certain comparative information for the year ended December 31, 2022 has been restated. Our opinion is not modified in respect of this matter.

Information Other than the Consolidated Financial Statements and Auditor’s Report Thereon

Management is responsible for the other information. The other information comprises the Management Discussion and Analysis but does not include the consolidated financial statements and our auditor’s report thereon.

Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS Accounting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company/Group to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

- Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because of the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

The engagement partner on the audit resulting in this independent auditor’s report is Ingrid Holbik.

Toronto, Canada Chartered Professional Accountants

Toronto, Canada

September 18, 2024

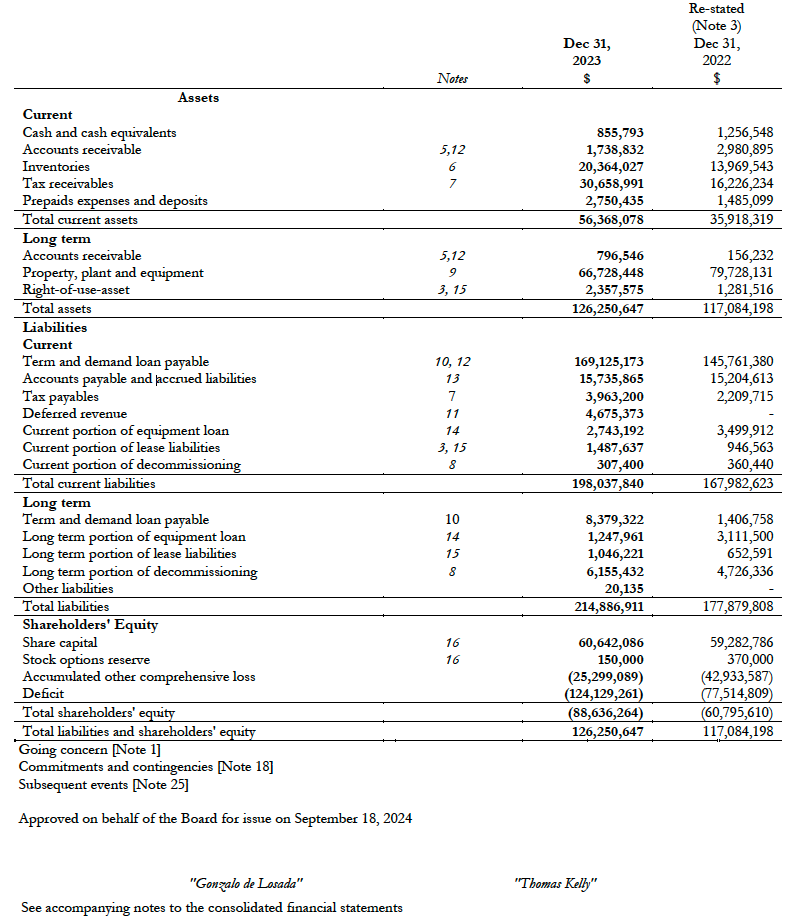

CONSOLIDATED STATEMENTS OFFINANCIAL POSITION

(Expressed in Canadian Dollars)

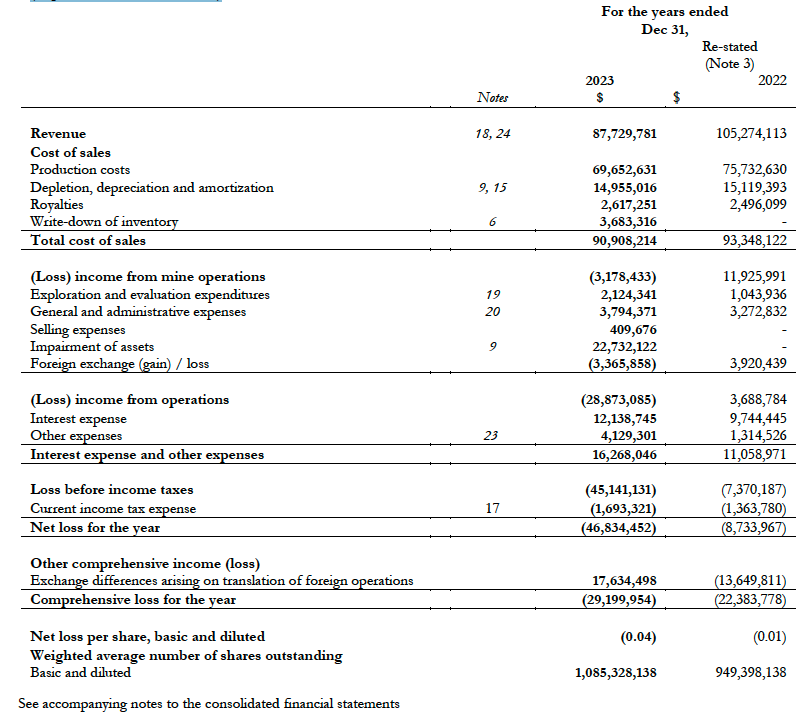

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Expressed in Canadian Dollars)

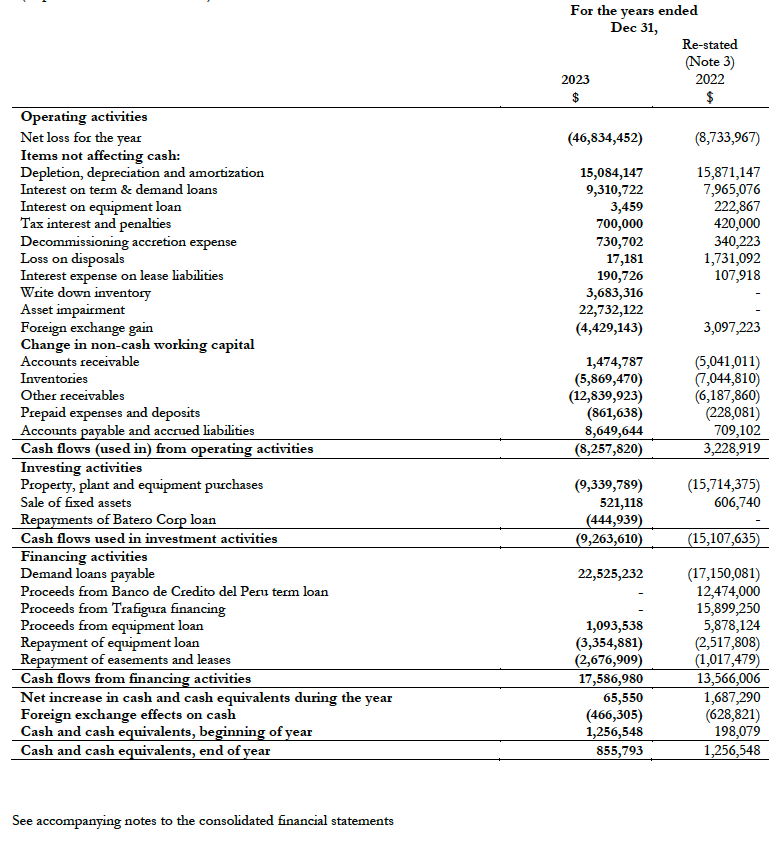

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in Canadian Dollars)

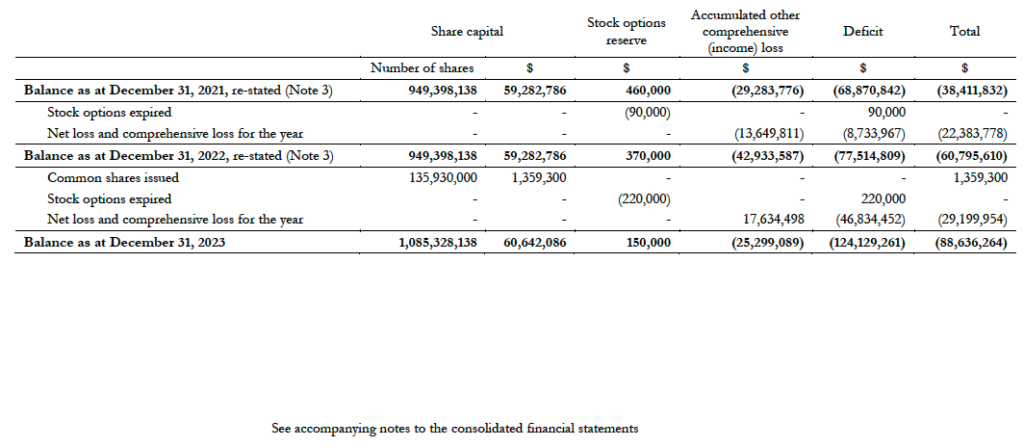

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDER´S EQUITY (DEFICIENCY)

(Expressed in Canadian Dollars)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in Canadian dollars)

NOTE 1. NATURE OF OPERATIONS AND GOING CONCERN

Antioquia Gold Inc. (“Antioquia” or the “Company”) was formed by way of amalgamation on April 25, 1997 and continued under the laws of British Columbia on March 24, 2016. The registered address of Antioquia is 2800 Park Place, 666 Burrard St., Vancouver, BC, V6C 2Z7. The Company is listed on the TSX Venture Exchange (“TSX-V”) under the symbol “AGD”. The Company trades on the OTCQX pink sheets, under the symbol “AGDXF”.

The Company’s primary focus is the operation of its Cisneros underground gold mine located outside Medellin Colombia. Commercial production was declared at the Cisneros mine on March 1, 2019.

These consolidated financial statements have been prepared using IFRS Accounting Standards applicable to a going concern, which assumes continuity of operations and realization of assets and settlement of liabilities in the normal course of business for the foreseeable future, which is at least twelve months from December 31, 2023. At December 31, 2023, the Company had a cumulative deficit of $ 124,129,261 (December 31, 2022 $ 77,514,809), and a working capital deficit of $ 141,669,762 (December 31, 2022 – working capital deficit of $ 132,064,304). The Company’s ability to continue as a going concern is dependent upon its ability to achieve profitable operations, generate sufficient funds and/or continue to obtain sufficient capital from investors to meet its current and future obligations. The recoverability of amounts shown for property and equipment is dependent on future profitable operations or proceeds from disposition of mineral interests. As a result of these risks, there is material uncertainty which may cast significant doubt as to the appropriateness of the going concern assumption. There can be no assurance that the steps management is taking will be successful. These consolidated financial statements do not reflect the adjustments to the carrying values of assets and liabilities and the reported expenses and consolidated statements of financial position classifications that would be necessary if the going concern assumption was inappropriate. These adjustments could be material.

The Company applied and received approval for a voluntary delisting of its common shares in the capital of the Company (the “Common Shares”) from the TSXV Venture Exchange (“TSXV”). Accordingly, it is anticipated that, effective as at the close of trading on Friday, December 1, 2023, Antioquia’s Common Shares are no longer listed and posted for the trading on the TSXV. A majority of the shareholders of the Company approved the voluntary delisting of the Common Shares at the annual and general and special meeting of the shareholders of the Company held on October 11, 2023. The Company will continue as an unlisted reporting issuer under Canadian securities laws.

NOTE 2. MATERIAL ACCOUNTING POLICIES

2.1 Basis of presentation

Basis of compliance

These consolidated financial statements have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IASB”).

The consolidated financial statements of the Company for the year ended December 31, 2023 were approved and authorized for issue by the Board of Directors on September 18, 2024.

Basis of presentation

The consolidated annual financial statements have been prepared using the measurement bases specified by IFRS Accounting Standards for each type of asset, liability, income and expense. Measurement bases are more fully described in the accounting policies below.

The preparation of financial statements in conformity with IFRS Accounting Standards requires management to make judgments, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. Actual results may differ from these estimates as the estimation process is inherently uncertain. Estimates are reviewed on an ongoing basis based on historical experience and other factors that are considered to be relevant under the circumstances. Revisions to estimates and the resulting effects on the carrying amounts of the Company’s assets and liabilities are accounted for prospectively. The critical judgments and estimates applied in the preparation of the Company’s consolidated financial statements are consistent with those applied and disclosed in Note 2 and are discussed below.

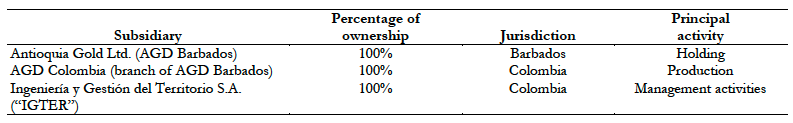

Basis of consolidation

The consolidated financial statements incorporate the financial statements of the Company and entities controlled by the Company. Control is achieved when the Company is exposed to variable returns and has the ability to affect those returns through power to direct the relevant activities. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Company controls another entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Company. Subsidiaries will be de-consolidated from the date that control ceases.

All transactions and balances between the Company and its subsidiaries are eliminated on consolidation, including unrealized gains and losses on transactions between the companies. Amounts reported in the financial statements of subsidiaries have been adjusted where necessary to ensure consistency with the accounting policies adopted by the Company. Profit or loss and other comprehensive income of subsidiaries acquired or disposed of during the period are recognized from the effective date of acquisition, or up to the effective date of disposal, as applicable.

Presentation and functional currency

The Company’s presentation and functional currency is the Canadian dollar. The functional currency of AGD Barbados is the United States dollar, and the functional currency of IGTER and AGD Colombia is the Colombian peso.

The functional currency accounts are translated into the presentation currency by translating assets and liabilities into Canadian dollars at exchange rates in effect at the consolidated statement of financial position date. Equity accounts are translated at historical exchange rates. Revenues and expenses are translated at the average exchange rate for the period. Any resulting gain or loss is recorded as a component of other comprehensive loss.

Foreign currency transactions are translated into the functional currency of the respective entity, using the exchange rates prevailing at the dates of the transactions (spot exchange rate). Foreign exchange gains and losses resulting from the settlement of such transactions and from the remeasurement of monetary items denominated in foreign currency at period-end exchange rates are recognized in profit and loss. Non-monetary items are not retranslated at period-end and are measured at historical cost (translated using the exchange rates at the transaction date), except for non-monetary items measured at fair value which are translated using the exchange rates at the date when fair value was determined.

2.2 Financial assets and liabilities

Financial assets

Initial recognition and measurement

Non-derivative financial assets within the scope of IFRS 9 are classified as either fair value through profit or loss (“FVPL”), fair value through other comprehensive income (“FVOCI”) or “financial assets at amortized costs”, as appropriate. The Company determines the classification of financial assets at the time of initial recognition based on the Company’s business model and the contractual terms of the cash flows.

All financial assets are recognized initially at fair value plus, in the case of financial assets not at FVPL, directly attributable transaction costs on the trade date at which the Company becomes a party to the contractual provisions of the instrument.

Financial assets with embedded derivatives are considered in their entirety when determining their classification at FVPL or at amortized cost. Cash and cash equivalents and other receivables held for collection of contractual cash flows are measured at amortized cost.

Subsequent measurement – financial assets at amortized cost

After initial recognition, financial assets measured at amortized cost are subsequently measured at the end of each reporting period at amortized cost using the Effective Interest Rate (“EIR”) method. Amortized cost is calculated by taking into account any discount or premium on acquisition and any fees or costs that are an integral part of the EIR. The EIR amortization is included in other income in the consolidated statements of loss.

Subsequent measurement – financial assets at FVPL

Financial assets measured at FVPL include financial assets management intends to sell in the short term and any derivative financial instrument that is not designated as a hedging instrument in a hedge relationship. Financial assets measured at FVPL are carried at fair value in the consolidated statements of financial position with changes in fair value recognized in other income or expense in the consolidated statements of loss. The Company does not have any financial assets classified as financial assets at FVPL.

Subsequent measurement – financial assets at FVOCI

Financial assets measured at FVOCI are non-derivative financial assets that are not held for trading and the Company has made an irrevocable election at the time of initial recognition to measure the assets at FVOCI. The Company does not measure any financial assets at FVOCI.

After initial measurement, investments measured at FVOCI are subsequently measured at fair value with unrealized gains or losses recognized in other comprehensive income or loss in the consolidated statements of comprehensive loss. When the investment is sold, the cumulative gain or loss remains in accumulated other comprehensive income or loss and is not reclassified to profit or loss.

Derecognition

A financial asset is derecognized when the contractual rights to the cash flows from the asset expire, or the Company no longer retains substantially all the risks and rewards of ownership.

Impairment of financial assets

The Company’s only financial assets subject to impairment are other receivables, which are measured at amortized cost. The Company has elected to apply the simplified approach to impairment as permitted by IFRS 9, which requires the expected lifetime loss to be recognized at the time of initial recognition of the receivable. To measure estimated credit losses, accounts receivables and other receivables has been grouped based on shared credit risk characteristics, including the number of days past due. An impairment loss is reversed in subsequent periods if the amount of the expected loss decreases and the decrease can be objectively related to an event occurring after the initial impairment was recognized.

Financial liabilities

Initial recognition and measurement

Financial liabilities are measured at amortized cost, unless they are required to be measured at FVPL as is the case for held for trading or derivative instruments, or the Company has opted to measure the financial liability at FVPL. All financial liabilities are recognized initially at fair value and in the case of long-term debt, net of directly attributable transaction costs.

Financial liabilities recognized in the consolidated statement of financial position include demand loan payable, accounts payable and accrued liabilities, and term loan payable all of which are measured at amortized cost. The respective accounting policies are described below.

Subsequent measurement – financial liabilities at amortized cost

After initial recognition, financial liabilities measured at amortized cost are subsequently measured at the end of each reporting period at amortized cost using the EIR method. Amortized cost is calculated by taking into account any discount or premium on acquisition and any fees or costs that are an integral part of the EIR. The EIR amortization is included in other income (expense) in the consolidated statements of loss.

Derecognition

A financial liability is derecognized when the obligation under the liability is discharged, cancelled or expires with any associated gain or loss recognized in other income or expense in the consolidated statements of loss.

2.3 Cash and cash equivalents

Cash and cash equivalents consist of cash on hand, cash held at a financial institution or investments having a maturity of ninety days or less at acquisition, that are readily convertible to the contracted amounts of cash.

2.4 Exploration and evaluation expenditures

The exploration and evaluation expenditure policy is to recognize exploration and evaluation expenditures within an area of interest as expense until management concludes that the technical feasibility and commercial viability of extracting a mineral resource are demonstrable and that future economic benefits are probable. In making this determination, the extent of exploration, as well as the degree of confidence in the mineral resource is considered. Once a project has been established as commercially viable and technically feasible and has been subject to an impairment analysis, further expenditures are capitalized and classified as development properties.

Exploration and evaluation expenditures consist primarily of:

- Gathering exploration data through topographical and geotechnical studies;

- Exploratory drilling, trenching and sampling;

- Determining the volume and grade of the resource;

- Test work on geology, metallurgy, mining, geotechnical and environmental; and

- Conducting engineering, marketing and financial studies.

2.5 Provisions and decommissioning liabilities

Provisions are recognized when the Company or its subsidiaries have a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of resources will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. The amount recognized as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period. If the effect of the time value of money is material, provisions are determined by discounting the expected future cash flows at a pre-tax rate that reflects current market assessments of the time value of money and, where appropriate, the risks specific to the liability. Where discounting is used, the increase in the provision due to the passage of time is recognized as a finance cost. Contingent liabilities are not recognized in the financial statements, if not estimable and probable, and are disclosed in notes to the financial information unless their occurrence is remote. Contingent assets are not recognized and are disclosed in the notes if their recovery is deemed probable.

Environmental rehabilitation

Provisions for environmental rehabilitation are made in respect of the estimated future costs of closure and restoration and for environmental rehabilitation costs (which include the dismantling and demolition of infrastructure, removal of residual materials and remediation of disturbed areas) in the accounting period when the related environmental disturbance occurs. The provision is discounted using a pre-tax rate, and the unwinding of the discount is included in finance costs. At the time of establishing the provision, a corresponding asset is capitalized and is depreciated over future production from the mining property to which it relates. The provision is reviewed each reporting period for changes in cost estimates, discount rates and operating lives. Changes to estimated future costs are recognized in the statement of financial position by adjusting the rehabilitation asset and liability. If, for mature mines, the revised mine assets net of rehabilitation provisions exceeds the carrying value, that portion of the increase is charged directly to expenses. For closed sites, changes to estimated costs are recognized immediately in profit and loss.

2.6 Property and equipment

Recognition and measurement

On initial recognition, property and equipment are valued at cost, being the purchase price and directly attributable cost of acquisition or construction required to bring the asset to the location and condition necessary to be capable of operating in the manner intended by the Company, including appropriate borrowing costs and the estimated present value of any future unavoidable costs of dismantling and removing items. The corresponding liability is recognized within provisions.

Property and equipment are subsequently measured at cost less accumulated depreciation, less any accumulated impairment losses, with the exception of land which is not depreciated. When parts of an item of property and equipment have different useful lives, they are accounted for as separate items (major components) of property and equipment.

Subsequent costs

The cost of replacing part of an item of property and equipment is recognized in the carrying amount of the item if it is probable that the future economic benefits embodied within the part will flow to the Company and its cost can be measured reliably. The carrying amount of the replaced part is derecognized. The costs of the day-to-day servicing of property and equipment are recognized in profit or loss as incurred.

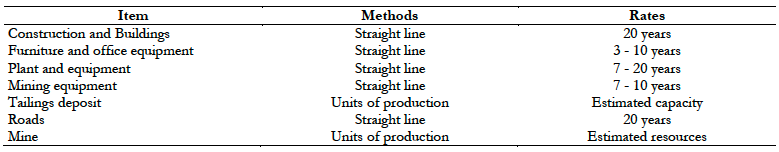

Depreciation

The carrying amounts of mine properties, plant and equipment are depreciated or depleted to their estimated residual value over the estimated economic life of the specific assets to which they relate, using the depreciation methods or depletion rates as indicated below. Estimates of residual values or useful lives and depreciation methods are reassessed annually and any change in estimate is taken into account in the determination of the remaining depreciation or depletion rate. Depreciation or depletion commences on the date the asset is available for its use as intended by management.

Depreciation is recognized in profit or loss and is calculated according to their lifetime as follows:

2.7 Impairment of non-financial assets

At each financial position reporting date the carrying amounts of the Company’s non-financial assets are reviewed to determine whether there is any indication that those assets are impaired. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment, if any. The recoverable amount is the higher of fair value less costs of disposal and value in use. Fair value is determined as the amount that would be obtained from the sale of the asset in an arm’s length transaction between knowledgeable and willing parties. In assessing value in use, the estimated future cash flows are discounted to their present value using a pretax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. If the recoverable amount of an asset is estimated to be less than its carrying amount, the carrying amount of the asset is reduced to its recoverable amount and the impairment loss is recognized in the profit or loss for the period.

When an impairment loss subsequently reverses, the carrying amount of the asset (or cash-generating unit) is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognized immediately in profit or loss.

2.8 Share capital

Financial instruments issued by the Company are classified as equity only to the extent that they do not meet the definition of a financial liability or financial asset. The Company’s common shares and warrants are classified as equity instruments. Incremental costs directly attributable to the issue of new shares, stock options or warrants are shown in equity as a deduction, net of tax, from the proceeds.

Share-based payments

The Company applies the fair value method of accounting for share-based payments granted to employees and other individuals providing similar services. The fair value of the options is determined using an option pricing model that takes into account, as of the grant date, the exercise price, the expected life of the option, the current price of the underlying stock and its expected volatility, expected dividends on the stock, forfeiture rate and the risk-free interest rate over the expected life of the option. Each tranche of an option that vests over time is considered a separate award and the fair value of each tranche is expensed over its vesting time-frame with the corresponding credit to the stock option reserve.

Share-based payments granted to non-employees are measured at the fair value of goods received unless that cannot be reasonably estimated in which case the fair value of the share-based payments is used. The measurement date is generally the date the goods or services are received.

Cash consideration received from employees on exercise of options is credited to share capital along with the original grant date fair value of the options exercised. The value of options that expire or are forfeited is removed from the stock option reserve and charged to deficit.

Warrants

All warrants issued under a unit financing arrangement are valued on the date of grant using the Black-Scholes option pricing model, net of related issue costs and are recorded in the warrant reserve. Cash consideration received on exercise of warrants is credited to share capital along with the original grant date fair value of the warrants exercised. Expired warrants are removed from the warrant reserve and credited to deficit.

2.9 Revenue recognition

The Company follows as 5-step process in determining whether to recognize revenue from the sale of precious metals, gold and silver:

- Identifying the contract with a customer;

- Identifying the performance obligations;

- Determine the transaction price;

- Allocating the transaction price to the performance obligations; and

- Recognizing revenue when/as performance obligation(s) are satisfied.

The Company earns revenue from contracts with customers for the sale of concentrate of gold and silver. Revenue from contracts with customers is generally recognized on the settlement date, which is the date the customer obtains control of the promised asset and the Company satisfies its performance obligation. The Company considers the terms of the contract in determining the transaction price. The transaction price is based upon the amount the Company expects to be entitled to in exchange for the transferring of the promised goods.

The transaction price is either fixed on the settlement date or at spot prices based upon the terms of the contract. The Company typically receives 95% of the payment within 3 days of the settlement date, and 5% with in 2 – 3 months when the exact amount of gold and silver of the transaction is known.

2.10 Royalties

All royalties payable by the Company are calculated based on gold value, and the royalty is presented as a cost of sales and accrued after production is finalized.

2.11 Inventories

Consumable inventories are valued at the lower of weighted average cost and net realizable value (“NRV”) and where appropriate, less a provision for obsolescence. Consumable inventory consists of items such as spare parts and explosives. Cost includes acquisition, freight and other directly attributable costs. NRV is estimated based on replacement costs.

Mineral inventories are valued at the lower of average production cost and NRV. The cost of mineral inventories includes all costs related to bringing the inventory to its current condition, including mining and processing costs, labour costs, materials and supplies, direct and allocated indirect operating overhead and depreciation expense. NRV is determined with reference to relevant market prices less applicable selling expenses.

2.12 Borrowing costs

Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets, until such time as the assets are substantially ready for their intended use or sale.

2.13 Leases

At inception of a contract, the Company assesses whether a contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. To assess whether a contract conveys the right to contract the use of an identified asset, the Company assesses whether:

- The contract involves the use of an identified asset – this may be specified explicitly or implicitly and should be physically distinct or represent substantially all of the capacity of a physically distinct asset. If the supplier has a substantive substitution right, then the asset is not identified;

- The Company has the right to obtain substantially all of the economic benefits from use of the asset throughout the period of use; and

- The Company has the right to direct the use of the asset. The Company has this right when it has the decision-making rights that are most relevant to changing how and for what purpose the asset is used. In rare cases where the decision as to how and for what purpose the asset is used is predetermined, the Company has the right to direct the use of that asset if either:

- The Company has the right to operate the asset; or

- The Company designed the asset in a way that predetermines how and for what purpose it will be used.

If a contract is assessed to contain a lease, a lease liability is recognized representing the present value of cash flows estimated to settle the contract, discounted using a discount rate which would be required if the underlying asset was acquired through a financing arrangement. The Company will also recognize a right-of-use asset (“ROU”) that will generally be equal to the lease obligation at adoption. The ROU is subsequently amortized over the life of the related asset.

2.14 Loss per share

Basic loss per share is calculated by dividing net loss by the weighted average number of common shares outstanding for the period. The computation of diluted loss assumes the conversion, exercise or contingent issuance of securities only when such conversion, exercise or issuance would have a dilutive effect on earnings per share. The dilutive effect of outstanding options and warrants and their equivalents is reflected in diluted earnings per share by application of the treasury stock method. In periods when the Company reports a loss, the effect of potential issuances of shares under options and warrants would be anti-dilutive, and is therefore not reported.

2.15 Income taxes

Tax expense recognized in profit or loss comprises the sum of deferred tax and current tax not recognized in other comprehensive income or directly in equity.

Current income tax assets and/or liabilities comprise those obligations to, or claims from, fiscal authorities relating to the current or prior reporting periods, that are unpaid at the reporting date. Current tax is payable on taxable profit or other current tax activities, which differs from profit or loss in the financial statements. Calculation of current tax expense is based on tax rates and tax laws that have been enacted or substantively enacted by the end of the reporting period.

Deferred income taxes are calculated using the liability method on temporary differences between the carrying amounts of assets and liabilities and their tax bases. However, deferred tax is not provided on the initial recognition of goodwill or on the initial recognition of an asset or liability unless the related transaction is a business combination or affects tax or accounting profit. Deferred tax on temporary differences associated with investments in subsidiaries and co-ownership is not provided if reversal of these temporary differences can be controlled by the Company and it is probable that reversal will not occur in the foreseeable future.

Deferred tax assets and liabilities are calculated, without discounting, at tax rates that are expected to apply to their respective period of realization, provided they are enacted or substantively enacted by the end of the reporting period. Deferred tax liabilities are always provided for in full.

Deferred tax assets are recognized to the extent that it is probable that they will be able to be utilized against future taxable income. To the extent that the Company does not consider it probable that a future tax asset will be recovered, it is not recognized in the financial statements.

Deferred tax assets and liabilities are offset only when the Company has a right and intention to offset current tax assets and liabilities from the same taxation authority.

Changes in deferred tax assets or liabilities are recognized as a component of taxable income or expense in profit or loss, except where they relate to items that are recognized in other comprehensive income or directly in equity, in which case the related deferred tax is also recognized in other comprehensive income or equity, respectively.

2.16 Use of estimates, judgements and assumptions

The Company makes estimates and assumptions about the future that affect the reported amounts of assets and liabilities. Estimates and judgements are continually evaluated based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. In the future, actual results may differ from these estimates and assumptions.

The effect of a change in an accounting estimate is recognized prospectively by including it in profit or loss in the period of the change.

Information about critical judgments and estimates in applying accounting policies that have the most significant risk of causing material adjustment to the carrying amounts of assets and liabilities recognized in the consolidated financial statements within the next financial period are discussed below:

Recoverable ounces

The figures for mineral reserves and mineral resources are determined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects, issued by the Canadian Securities Administrators. This National Instrument lays out the standards of disclosure for mineral projects including rules relating to the determination of mineral reserves and mineral resources. There are uncertainties inherent in estimating mineral reserves and mineral resources, including many factors beyond the Company’s control. Such estimation is a technical process, and the accuracy of any mineral reserve or mineral resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgements used in engineering and geological interpretation.

Differences between management’s assumptions, and actual events including economic assumptions such as metal prices and market conditions, could have a material effect in the future on the Company’s financial position and results of operation.

Estimation of provision for environmental rehabilitation

The Company has obligations for environmental rehabilitation related to its property. The future obligations for mine closure activities are estimated by the Company using the mine closure plans. Because the obligations are dependent on the Colombian laws and regulations in which the mines operate, the requirements could change as a result of amendments in the laws and regulations relating to environmental protection and other legislation affecting resource companies. As the estimate of obligations is based on future expectations, a number of estimates and assumptions are made by management in the determination of environmental rehabilitation provision. The environmental rehabilitation provisions are more uncertain the further into the future the mine closure activities are to be carried out.

Identification and measurement of impairment of property, plant and equipment

At each reporting date, the Company applies significant judgment in assessing (a) whether events or circumstances (“impairment indicators”) indicate the recoverable amount may be greater than or less than the carrying amount and (b) whether or not there has been an impairment or reversal thereto of property, plant and equipment. The recoverable amount is the higher of the fair value less costs to sell and value in use which both are based on the expected future cash flows to be generated from the assets. Significant assumption include life of mine, future projection profiles, future gold prices, mineral reserves and resources estimates, discount rates, operating costs, capital expenditures and estimates regarding future pricing and inflation. Assumptions underlying the fair value estimates are subject to risks and uncertainties.

Inventory valuation

Finished goods, work-in-process, and stockpile ore are valued at the lower of cost and net realizable value. The assumptions used in the valuation of work-in-process inventories include estimates of gold in stockpile, the amount of gold in the mill circuits and assumption of the gold price expected to be realized when the gold is recovered. If these estimates or assumptions prove to be inaccurate, the Company could be required to write-down the recorded value of its work-in-process inventories and stockpile, which would reduce earnings and working capital.

Income taxes and recoverability of potential deferred tax assets

In assessing the probability of realizing income tax assets recognized, management makes estimates related to expectations of future taxable income, applicable tax planning opportunities, expected timing of reversals of existing temporary differences and the likelihood that tax positions taken will be sustained upon examination by applicable tax authorities. In making its assessments, management gives additional weight to positive and negative evidence that can be objectively verified. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. The Company considers whether relevant tax planning opportunities are within the Company’s control, are feasible, and are within management’s ability to implement. Examination by applicable tax authorities is supported based on individual facts and circumstances of the relevant tax position examined in light of all available evidence. Where applicable tax laws and regulations are either unclear or subject to ongoing varying interpretations, it is reasonably possible that changes in these estimates can occur that materially affect the amounts of income tax assets recognized. Also, future changes in tax laws could limit the Company from realizing the tax benefits from the deferred tax assets. The Company reassesses unrecognized income tax assets at each reporting period.

Determination of functional currency

Functional currency is determined annually for each entity based on a set of primary and secondary factors that include; the currency that influences sales prices for goods and services; the currency of the country that determines the sales prices of goods and services; the currency that mainly influences the costs of providing goods and services; the currency in which funds from financing activities are generated; the currency in which receipts from operating activities are usually retained. When the factors do not provide clear indicators, management judgement must be applied in the determination of functional currency.

Gold Purchase & Sale Agreement

The Company entered into a gold purchase and sale contract with Trafigura Pte Ltd. (“Trafigura”). Under the contract, the Company will make sales of gold concentrate at market prices to Trafigura for a period of 2 years, with minimum annual deliveries of 11,050 wet metric tonnes. The Company intends to settle minimum deliveries using the Company’s own production, and thus the own use exemption is applied. The Company has determined that the gold purchase and sale contract represents an executory contract to sell gold concentrate at market prices. Significant judgment was applied in the application of the own use exemption.

Gold Prepayment Agreement

The Company entered into a gold prepayment agreement with Trafigura. The Company was advanced US $12,750,000 to be applied against receivables that arise from sale of gold concentrate under the gold purchase contract for a period of 2 years. Based on an analysis of the contact terms in accordance with IFRS Accounting Standards, the Company has determined that the gold prepayment agreement represents a financing contract. As a result, the amount is recorded as a financial liability and presented in in the balance sheet under the line item “Term and demand loan payable” at amortized cost in accordance with IFRS 9. Significant judgment was applied in the determination that the gold prepay contract represents a financing arrangement.

Leases

Critical judgements required in the application of IFRS 16 included, among others, the following:

- Identifying whether a contract (or part of a contract) includes a lease,

- Determining whether it is reasonably certain that an extension or termination option will be exercised,

- Classification of lease agreements (when the entity is a lessor),

- Determination whether variable payments are in-substance fixed,

- Determining the stand-alone selling prices of lease and non-lease components.

Key sources of estimation uncertainty in the application of IFRS 16 include, among others, the following:

- Estimation of the lease term,

- Determination of the appropriate rate to discount the lease payments,

- Assessment of whether a right-of-use asset is impaired.

Other estimates

Other significant estimates which could materially impact the consolidated financial statements include:

- The inputs used in accounting for share purchase option expense in the consolidated statements of income / (loss);

- The estimated useful lives of property, plant and equipment which are included in the consolidated statements of financial position and the related depreciation included in the consolidated statements of income / (loss) and comprehensive income / (loss).

2.17 Adoption of new accounting standards

The Company has adopted the following amendments to IFRS standards:

Amendments to IAS 1 Presentation of Financial Statements (effective January 1, 2023):

These amendments clarify the classification of liabilities as current or non-current and promote consistency in application. The Company has reviewed its liabilities and their presentation in light of these changes. The adoption of these amendments had no impact on the Company’s financial statements.

Amendments to IAS 8 ‘Accounting Policies, Changes in Accounting Estimates and Errors’ (effective January 1, 2023):

These amendments introduce a new definition of accounting estimates and clarify the distinction between changes in accounting estimates and changes in accounting policies. The Company has applied this guidance in preparing these financial statements. The adoption of these amendments had no impact on the Company’s financial statements.

Amendments to IAS 12 “Income Taxes” (effective January 1, 2023):

These amendments narrow the scope of the initial recognition exemption under IAS 12, clarifying its application to transactions that give rise to both deductible and taxable temporary differences. The adoption of these amendments had no impact on the Company’s financial statements

2.18 New standards, interpretations and amendments not yet effective

At the date of the authorization of these financial statements, several new, but not effective Standards and amendments to existing Standards, and Interpretations have been published by the IASB. None of these Standards or amendments to existing Standards have been adopted early by the Company. Management anticipates that all relevant pronouncements will be adopted for the first period beginning on or after the effective date of the pronouncement.

Classification of Liabilities as Current or Non-Current (Amendments to IAS 1)

The IASB has published Classification of Liabilities as Current or Non-Current (Amendments to IAS 1) which clarifies the guidance on whether a liability should be classified as either current or non-current. The amendments:

• Clarify that the classification of liabilities as current or non-current should only be based on rights that are in place “at the end of the reporting period”

• Clarify that classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of a liability

• Make clear that settlement includes transfers to the counterparty of cash, equity instruments, other assets or services that result in extinguishment of the liability.

This amendment is effective for annual periods beginning on or after January 1, 2024. Earlier application is permitted. The extent of the impact of adoption of this amendment has not yet been determined.

NOTE 3. CORRECTION OF PRIOR PERIOD ERRORS

During the current reporting period, the Company identified a material prior period error. The error has been retroactively corrected by restating each of the affected financial statement line items for the prior periods as follows:

Tax Exposure on Foreign Affiliate Intercompany Loan: The Company identified a tax exposure of $2.2 million related to foreign affiliate intercompany loan, pertaining to items from 2021 and prior years. This amount represents estimated penalties and interest associated with the exposure.

The impact of these restatements on the financial statements is summarized in the following table. These corrections did not have an impact on the Consolidated Statement of Cash Flows as the adjustment is non-cash and did not have a material impact on the basic and diluted earnings per share.

NOTE 4. FINANCIAL RISK MANAGEMENT

The Company has exposure to the following risks from its use of financial instruments: credit risk, liquidity risk, market risk, foreign currency risk, commodity price risk, interest rate risk and fair value.

4.1 Credit risk

Cash consists of bank balances and short-term deposits maturing in less than one year. The Company manages the credit exposure related to short term investments by selecting counterparties based on credit ratings and monitors all investments to ensure a stable return, avoiding complex investment vehicles with higher risk such as asset backed commercial paper.

The carrying amount of accounts receivable and cash and cash equivalents represents the maximum credit exposure. The Company does not have expected credit losses and did not provide for any losses, nor was it required to write off any receivables during the year ended December 31, 2023 and 2022.

4.2 Market risk

Market risk is the risk that changes in market factors, such as foreign exchange rates, commodity prices, and interest rates, and liquidity will affect the Company’s net income or the value of financial instruments. The objective of market risk management is to mitigate risk exposures within acceptable limits, while maximizing returns.

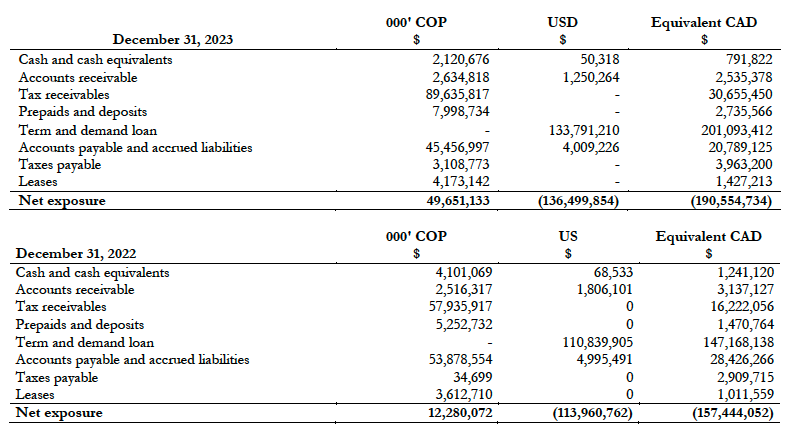

Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows will fluctuate as a result of changes in foreign currency exchange rates. The Company is exposed to foreign currency fluctuations as certain transactions are denominated in Colombian Pesos and United States dollars.

Should the Canadian dollar strengthen or weaken 10% vis-a-vis the underlying functional currencies, then a translation gain or loss of approximately $18,000,000 (December 2022 – $14,000,000) respectively would arise and would be recorded through other comprehensive income. Should the US dollar strengthen or weaken by 10%, then a foreign currency gain or loss of $ 16,400,000 (December 2022 – $ 15,400,000) would arise and be recorded in net loss.

The table shows the balances held in foreign currencies:

Commodity prices risk

Price risk is the risk that the fair value or future cash flows of the Company’s financial instruments will fluctuate because of changes in market prices. Gold and silver prices can be subject to volatile price movements, which can be material and can occur over short periods of time and are affected by numerous factors, all of which are beyond the Company’s control. The Company may enter commodity hedging contracts from time to time to reduce its exposure to fluctuations in spot commodity prices.

As at December 31, 2023, the Company had no outstanding commodity hedging contracts in place.

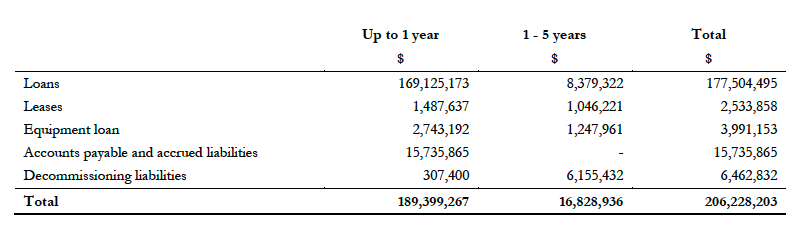

4.3 Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they become due. The Company’s approach to managing liquidity is to ensure. as much as possible. that it will have sufficient liquidity to meet its liabilities when due. under both normal and unusual conditions without incurring unacceptable losses. relinquishment of properties or risking harm to the Company’s reputation.

The Company prepares annual revenue and expenditure budgets. which are regularly monitored and updated as considered necessary to provide current cash flow estimates. The Company also utilizes authorizations for expenditures on operations and projects to further manage cash flows.

4.4 Interest rate

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Company’s interest rate risk is minimal as there are no variable rate interest-bearing outstanding loans. The Company has not entered into any interest rate swaps or other active interest rate management programs at this time.

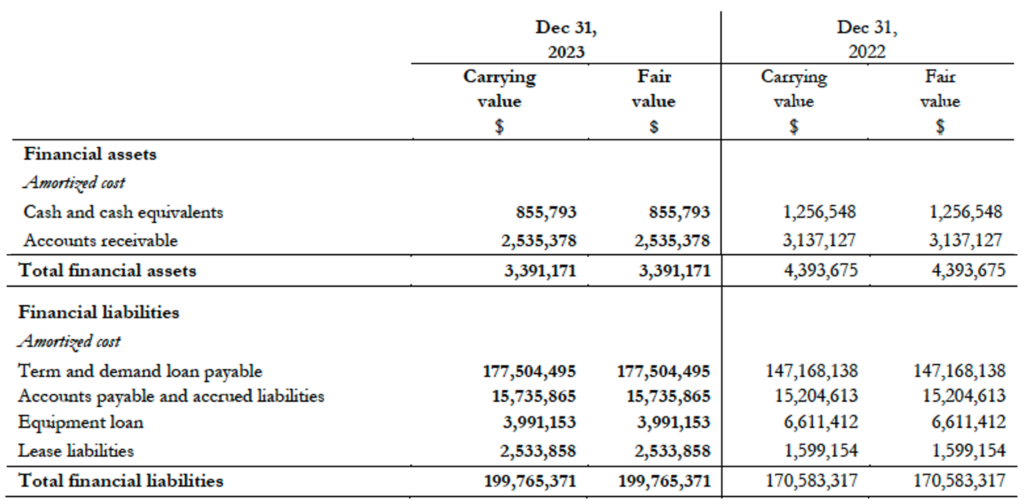

4.5 Fair value

All financial instruments that are measured at fair value are categorized into one of three hierarchy levels, described below. for disclosure purposes. Each level is based on the transparency of the inputs used to measure the fair values of assets and liabilities.

Level 1 – inputs are unadjusted quoted prices of identical instruments in active markets.

Level 2 – inputs other than quoted prices included in Level 1 that are observable for the comparable asset or liability, either directly or indirectly.

Level 3 – one or more significant inputs used in a valuation technique are unobservable in determining fair values of the instruments.

As at December 31, 2023 and 2022, the Company did not have any financial instruments carried at fair value that required classification within the fair value hierarchy.

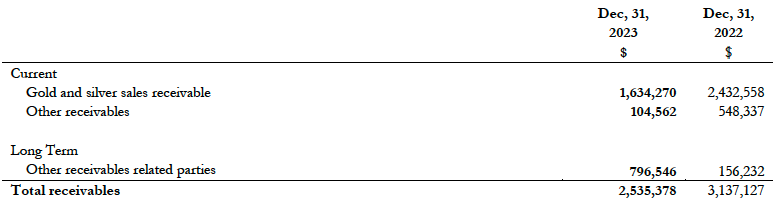

NOTE 5. ACCOUNTS RECEIVABLE

Other current receivables are related to a claim of a loss of concentrate theft $Nil (December 31, 2022 – $ 200,968) and equipment sold to Bancolombia with the purpose of carrying out a leaseback $Nil (December 31, 2022 – $ 337,832).

Other long-term receivables from related party are related to amounts due from Batero Gold Corp. See Note 12, Related Party Transactions for more.

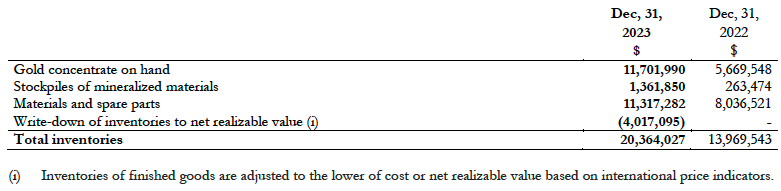

NOTE 6. INVENTORIES

The amount of inventory recognized as a cost of production for the year ended December 31, 2023 was $ 90,908,214 ($ 93,348,122 – December 31, 2022).

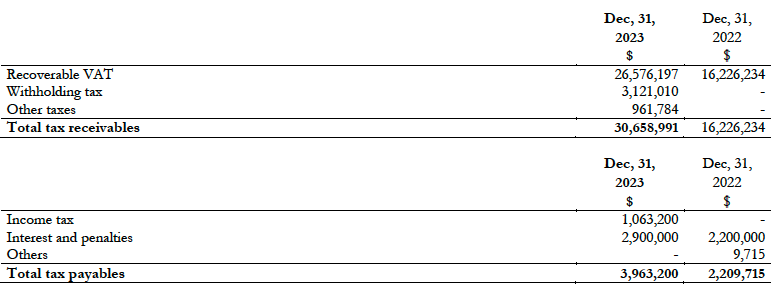

NOTE 7. TAX RECEIVABLES AND TAX PAYABLES

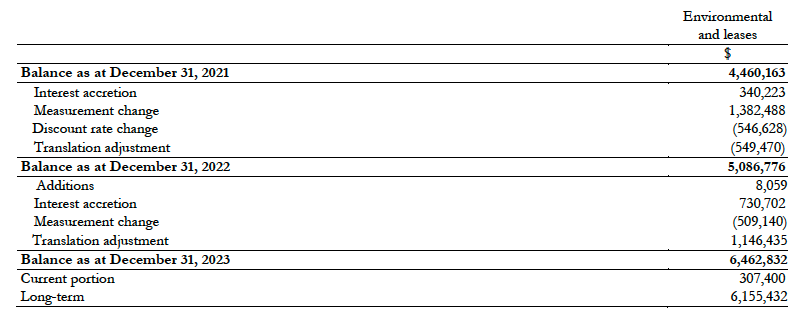

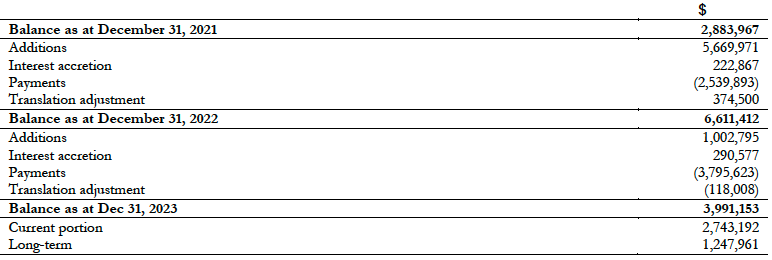

NOTE 8. ASSET RETIREMENT OBLIGATION

The Company is committed to a program of environmental protection and has estimated its total decommissioning costs on its Cisneros project to be approximately $6,490,969. The Company discounted the environmental provision and decommissioning costs to its net present value of $6,454,773 at December 31, 2023 using a discount rate of 10.06% over a three year period (December 31, 2022 – 12.83%). The obligation is expected to be paid out in the year 2026.

The following table presents the reconciliation of the beginning and ending carrying amount of the provision for closure and reclamation associated with the retirement of the Company’s property and equipment and lease decommissioning:

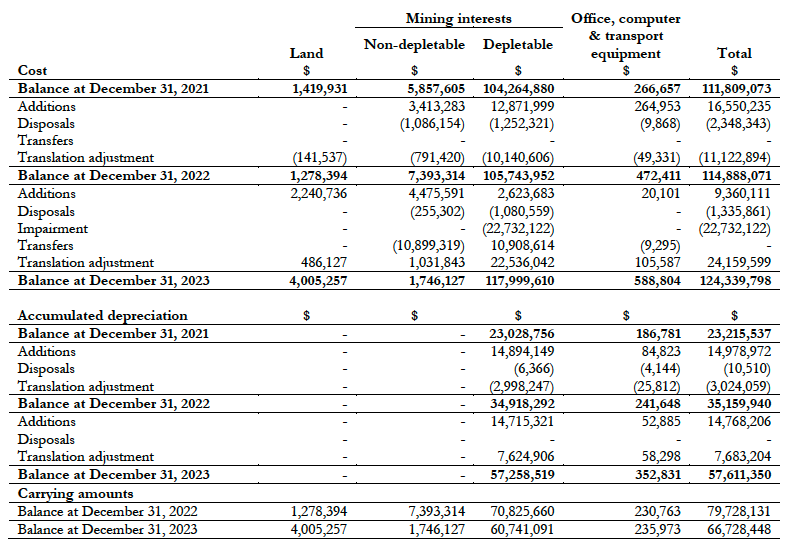

NOTE 9. PROPERTY. PLANT AND EQUIPMENT

The Company owns certain mining concessions in Colombia. The operation is subject to a 4% royalty payable to the Colombian Government and is subject to a 1% royalty payable to the vendors of the property.

Asset disposals include non-cash $ 509,140 related to asset retirement obligation change.

The Company assesses at each reporting date whether there is an indication that an asset may be impaired. If any indication exists, the Company estimates the asset’s recoverable amount. An asset’s recoverable amount is the higher of an asset’s or cash-generating unit’s (CGU) fair value less costs of disposal and its value in use.

During the year ended December 31, 2023, the Company recognized impairment losses of $22,732,122 (2022: $nil) related to Property, Plant and Equipment, including mining properties, fully allocated to the mining segment and reported under “Impairment of assets” line in the consolidated statements of loss and comprehensive loss.

This impairment primarily resulted from downward revisions to reserve estimates for the Guaico and Guayabito gold mines, due to verifiable estimates of reserves. The recoverable amount of $61,917,878 was determined based on a value in use calculation using cash flow projections from financial budgets approved by management covering a three-year period. The discount rate applied to the cash flow projections was 13% reflecting current market assessments of the time value of money and risks specific to operation. Key assumptions included a gold price of $2,133 per ounce and an estimated production of 147,937 ounces over the life of mine, derived from life-of-mine plans and resource conversion expectations.

As of December 31, 2023, there are non-depreciable mine assets with a value of $ 1,746,127 related to construction not completed: ore sorting process and tailing deposit expansion.

A summary of the depreciation recorded during the years ended December 31, 2023 and 2022 is as follows:

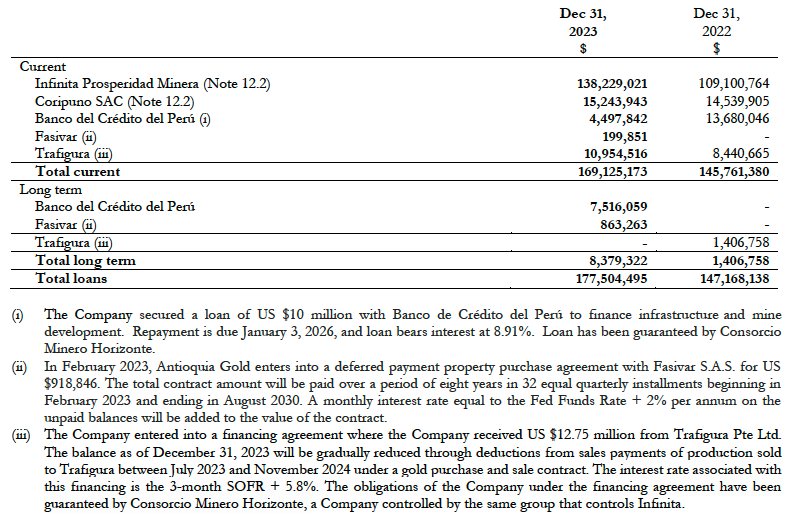

NOTE 10. TERM AND DEMAND LOAN

NOTE 11. DEFERRED REVENUE

The Company receives advance payments from gold concentrate sales when the lots are completed at the mine site. The Company delivers those lots on average 30 to 45 days after. The balance as of December 31, 2023, corresponds to production of the last days of December and is expected to be delivered in the next three months.

NOTE 12. RELATED PARTY TRANSACTIONS

During the years ended December 31, 2023 and 2022, the Company had the following related party transactions:

12.1 Key Management

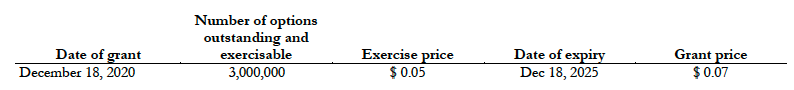

Key management personnel had the following transactions with the Company:

- Compensation that was paid or payable to key management in the amount of $ 304,375 (December 31, 2022 – $298,276).

- Directors of the Company have 3,000,000 options outstanding and exercisable at December 31, 2023.

- The Company has entered into consulting agreements with one director, pursuant to which he receives fees of US $7,500 per month. The contract can be terminated by the Company and the officers, at any time.

12.2 Related party transactions

Infinita Prosperidad Minera SAC (“Infinita”), a company owning approximately 91% of the outstanding common shares of the Company, had the following transactions with the Company:

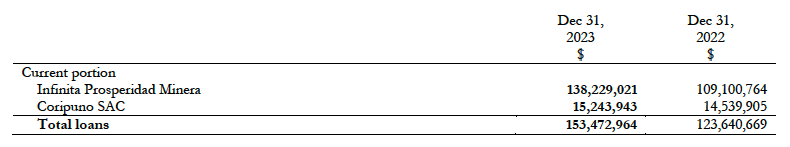

- The total term and demand loans and interest thereon at December 31, 2023 amounts to $138,229,021 (US$ 104,513,096) (December 31, 2022 – $109,100,764). The total loans plus interest are unsecured, denominated in US dollars, bear interest at 10%.

- During the year ended December 31, 2023 the Company made repayments in the amount of $2,277,517 (US$1,722,000) (December 31, 2022 – $11,649,289).

- Infinita entered into a debt arrangement with a third party lender for $72 million USD. Infinita has guaranteed the loan with its shares in the Company.

- On June, 2023, the Company completed its restructuring of $1,359,300 of debt under an existing loan agreement with Infinita. Pursuant to the Debt Restructuring, Antioquia issued 135,930,000 common shares at a deemed price of $0.01 per share. Prior to the Debt Restructuring, Infinita owned and controlled 853,351,437 common shares, representing approximately 89.9% of the issued and outstanding common shares of the Company. After closing of the Debt Restructuring, Infinita owns and controls 989,281,437 common shares, representing approximately 91.15% of the issued and outstanding common shares of the Company.

Coripuno SAC, a Company controlled by the same group that controls Infinita, had the following transactions with the Company:

- The total term and demand loans and interest thereon at December 31, 2023 amounts to $15,243,943 (US$ 11,525,740) (December 31, 2022 – $14,539,905). The total loans plus interest are unsecured, denominated in US dollars, bear interest at 7.13% and are due on demand.

Consorcio Minero Horizonte SA (CMH), a Company controlled by the same group that controls Infinita, had the following transactions with the Company:

- The Company sold gold concentrate in the amount of $Nil (US$ Nil) (December 31, 2022 – $14,540,920) to Consorcio Minero Horizonte SA.

- CMH has signed as guarantor in the demand loan obtained by the Company with Banco de Peru for the amount of USD $10,000,000

Batero Gold Corp, a Company controlled by the same group that controls Antioquia, and shares two of the Directors, had the following transactions with the Company:

- During the year ended December 31, 2023, the two companies shared office space. The amount of $29,268 (December 31, 2022 $50,247) were billed by the Company to Batero Gold Corp.

- As at December 31, 2023, the Company lent to Batero Gold Corp the amount of $733,590 (December 31, 2022 154,000), over 15 months expiring January 20, 2024. The total loan and interest that Batero owes to the Company at December 31, 2023 is $ 796,546. The total loan plus interest are unsecured, denominated in US dollars, bear interest at the Reference Banking Indicator (IBR) + 7.5%. The IBR is a short-term interest rate for the Colombian Peso.

-INPROSMIN S.A, a Company controlled by the same group that controls Infinita, had the following transactions with the Company:

- During the year ended December 31, 2023, the Company advanced of $72,946 (December 31, 2022 $Nil) to Inprosmin S.A.

12.3 Term and demand loan

During the year ended December 31, 2023, interest of $ 8,938,429 (December 31, 2022 – $5,942,579) has been expensed and accrued as demand loan payable.

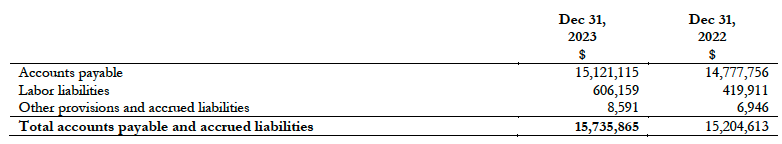

NOTE 13. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

NOTE 14. EQUIPMENT LOAN

The Company has an arrangement with Caterpillar Mexico and Epiroc Financial Solutions to finance underground mining equipment in the amount of 3,991,153 (US$ 3,050,338) over a 3 year period with annual interest rates between 4% and 8.25% per annum.

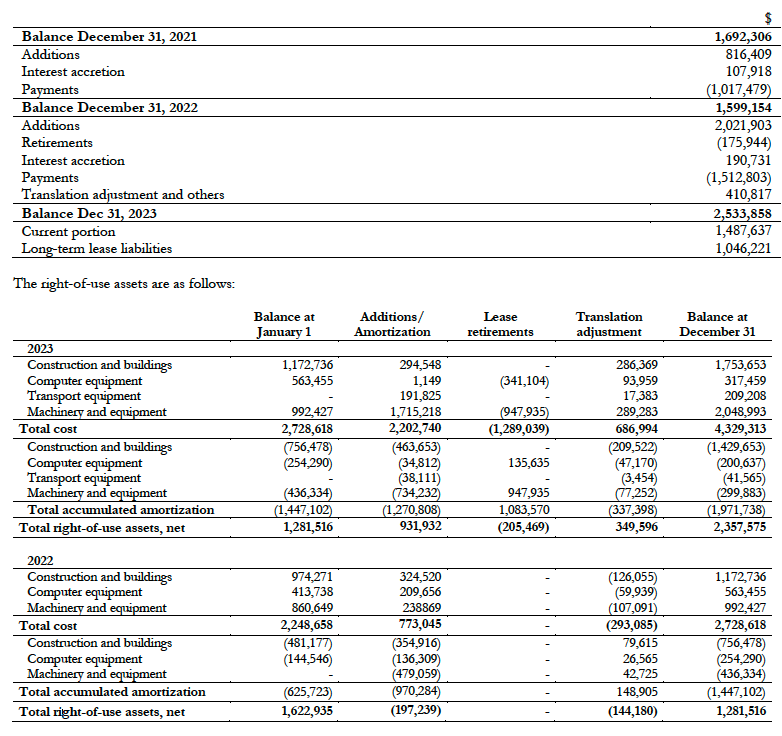

NOTE 15. RIGHT OF USE ASSETS AND LEASE LIABILITIES

The Company has the following types of leasing arrangements:

Mining land easements

In 2015 and 2017 the Company signed 2 contracts in connection with the acquisition of easements related to the Company’s properties. with a term of 7 and 10 years respectively. The value of the obligation related to acquisition of the easements has been discounted to its present value using an annual interest rate of 11.36% and the difference between the face value of the obligation and the discounted value is being accreted to income over the life of the obligation.

Lease contracts

The Company has a right-of-use asset related to leases of the office space in Medellin, mine equipment, technology equipment and camp at the site.

The lease liability is as follows:

NOTE 16. SHARE CAPITAL

- Authorized: Unlimited common shares.

The authorized capital of the Company consists of an unlimited number of common shares. As at December 31, 2023 there were 1,085,328,138 issued and outstanding common shares.

On June, 2023, the Company completed its restructuring of $1,359,300 of debt under an existing loan agreement with Infinita Prosperidad Minera SAC (“Infinita”), the Company’s largest shareholder. Pursuant to the Debt Restructuring, Antioquia issued 135,930,000 common shares at a deemed price of $0.01 per share. Prior to the Debt Restructuring, Infinita owned and controlled 853,351,437 common shares, representing approximately 89.9% of the issued and outstanding common shares of the Company. After closing of the Debt Restructuring, Infinita owns and controls 989,281,437 common shares, representing approximately 91.15% of the issued and outstanding common shares of the Company.

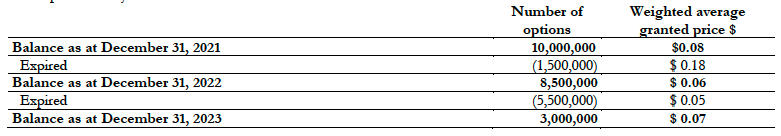

- Stock options

The Company has a stock option plan that provides for the issuance to its directors, officers, employees and consultants options to purchase from treasury a number of common shares not exceeding 10% of the common shares that are outstanding from time to time which is the number of shares reserved for issuance under the plan. The options are non-transferable if not exercised.

Stock option activity:

During the year ended December 31, 2023, the estimated grant date value of the 5,500,000 expired. Options in the amount of $220,000 was transferred from the option reserve to deficit. During the year ended December 31, 2022, the estimated grant date value of the 1,500,000 expired. Options in the amount of $ 90,000 was transferred from the option reserve to deficit.

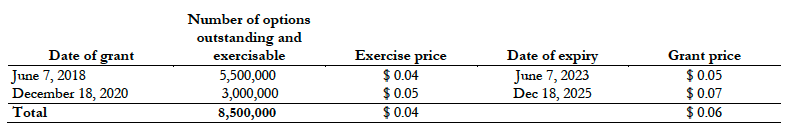

The following table provides details of the options outstanding and exercisable at December 31, 2023:

The following table provides details of the options outstanding and exercisable at December 31, 2022:

The weighted average time to expiry for the options outstanding as at December 31, 2023 is 1.97 years (December 31, 2022 – 1.33 years).

NOTE 17. INCOME TAXES

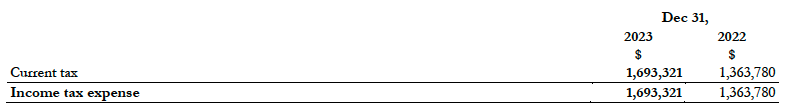

The major components of income tax expense are as follows:

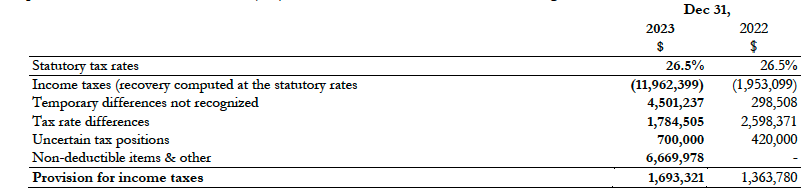

The Company’s provision for income tax differs from the amount computed by applying the combined Canadian federal and provincial income tax rates to income (loss) before income taxes as result of the following:

The enacted tax rates in Canada of 26.5% (26.5% – 2021) and Colombia of 35% (31% – 2021) where the Company operates are applied in the tax provision calculation.

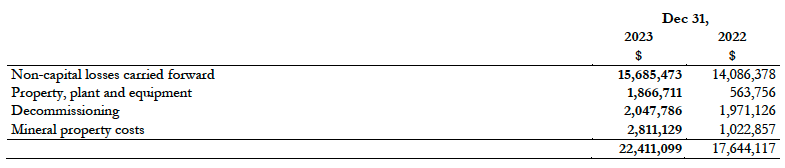

The following temporary differences have not been recognized in the Company’s consolidated financial statements.

As at December 31, 2023, the Company has Colombian non-capital losses of $Nil. (2022 – $18,830,022). In 2022 this non-capital losses were applied against Colombian taxable income in 2022.

As at December 31, 2022, the Company has Canadian non-capital losses of $10,068,256 (2021 – $9,696,803) that have not been recognized and may be carried forward and applied against Canadian taxable income of future years and begin expiring in 2026.

Uncertain tax provisions arise in the normal course of business and in the interpretation of tax legislation with regard to multinational structures. During the year, the Company recognized uncertain tax provisions of $700,000 (2022- $Nil). The Company does not have any material unresolved tax matters or disputes with the tax authorities.

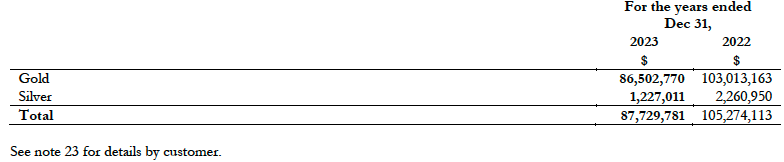

NOTE 18. REVENUE

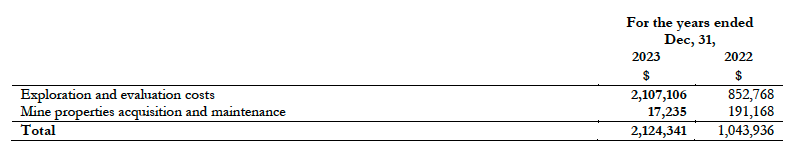

NOTE 19. EXPLORATION AND EVALUATION EXPENDITURES

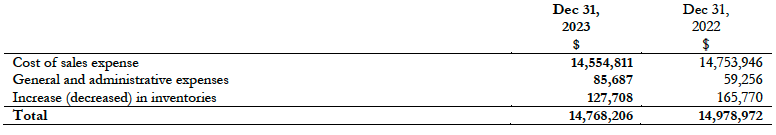

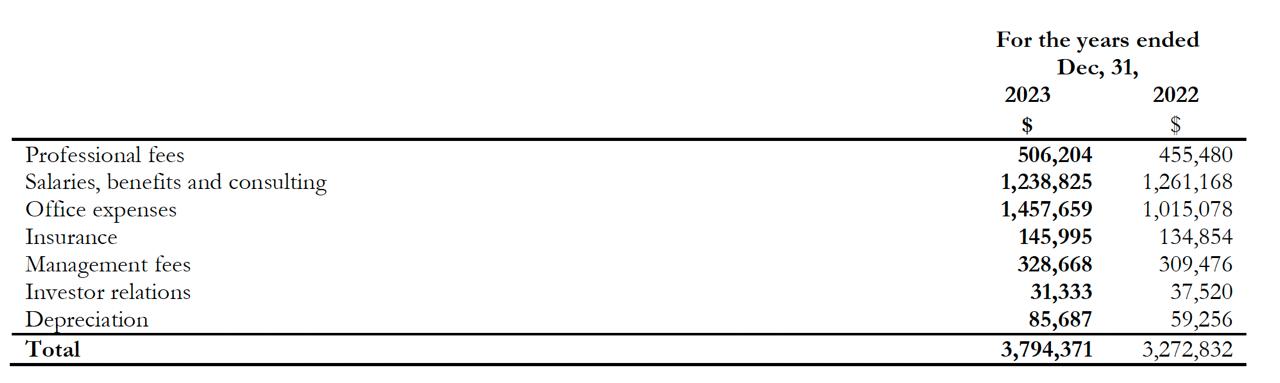

NOTE 20. GENERAL AND ADMINISTRATIVE EXPENSES

NOTE 21. CAPITAL MANAGEMENT

The Company’s objective when managing capital, defined as its shareholders’ equity plus term and demand loans and lease payable in the amount of $ 91,402,089 (December 31, 2022 – $ 87,971,682), is to safeguard its ability to continue as a going concern, and to pursue the development of its properties. The Company manages its capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets and seeks to retain sufficient equity to ensure that cash flows from assets will be sufficient to meet future cash flow requirements. In order to maintain or adjust the capital structure. the Company may from time to time issue shares and adjust its capital spending. To assess capital and operating efficiency and financial strength. the Company continually monitors its net cash and working capital. The Company’s capital management objectives, policies and processes have remained unchanged during the year ended December 31, 2023.

The Company is not subject to any capital requirements imposed by a lending institution or regulatory body.

NOTE 22. COMMITMENTS AND CONTIGENCIES

The Company has the following commitments under agreements entered into:

(A9)Effective March 1, 2010, the Company adopted a resolution whereby each director, that is not a Named Executive Officer “NEO”, is to be paid a $1,500 per month fee to be earned at the time that any stock options or warrants are exercised by the director. The director will be required to pay for the stock options or warrants exercised in full at the time of exercise. Upon exercise and payment of the stock options or warrants, the director will then receive payment for contingent directors’ fees to date, which amount shall not exceed the amount of the exercise of stock options or warrants. This amount represents a contingent liability and will only be paid to a director under the following conditions; 1) they continue to be a director. 2) they pay for the options and warrants exercised in full at the time of exercise, and 3) they exercise their options and warrants.

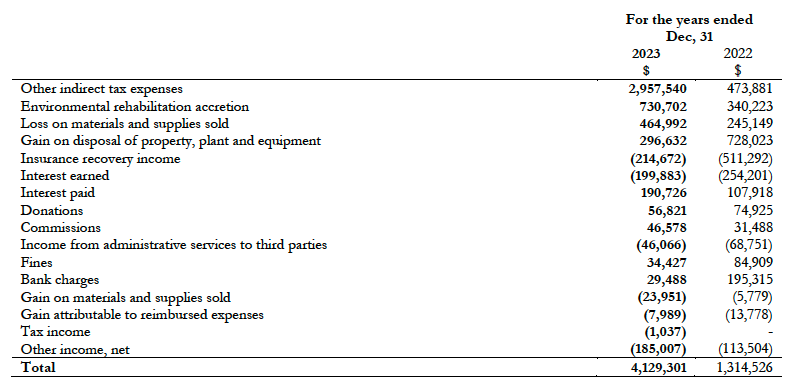

NOTE 23. OTHER (INCOME) / EXPENSES

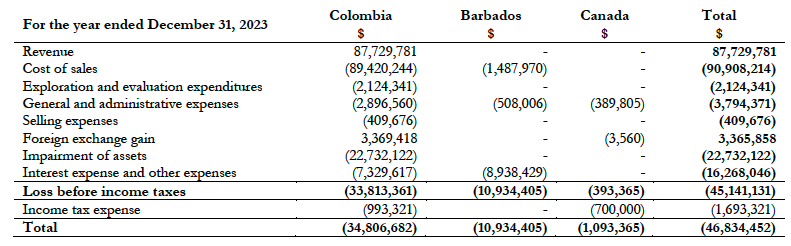

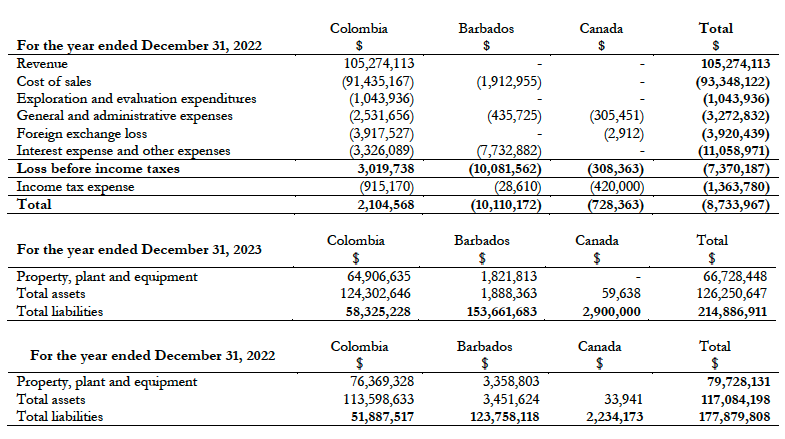

NOTE 24. SEGMENTED INFORMATION

Results of the operating segments are reviewed by the Company’s chief operating decision makers (“CODM”) to make decisions about resources to be allocated to the segments and to assess their performance. Each CODM is a member of the senior management team who rely on management positioned in the geographical regions where the key operations are located.

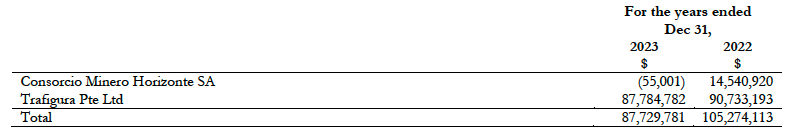

The Company has one operating and reporting segment in mining which operates in one geographic area – Colombia and is listed in Canada. The Company’s revenue by location of operations and information about the Company’s assets by location are detailed below:

Sales by customer

NOTE 25. SUBSEQUENT EVENT

No subsequent events identified.